Robert Solow pioneered growth theory focused on capital investment and productivity. Joseph Schumpeter added the concept of creative destruction arising from the introduction of new technology. Paul Romer made technology endogenous, responding to perceived economic opportunities. Recent empirical analysis of patent data shows periodic surges in high-impact innovation over nearly two centuries. Major financial crises have frequently followed frenzied periods of overinvestment when business processes could not fully exploit the capabilities of newly emerging technologies.

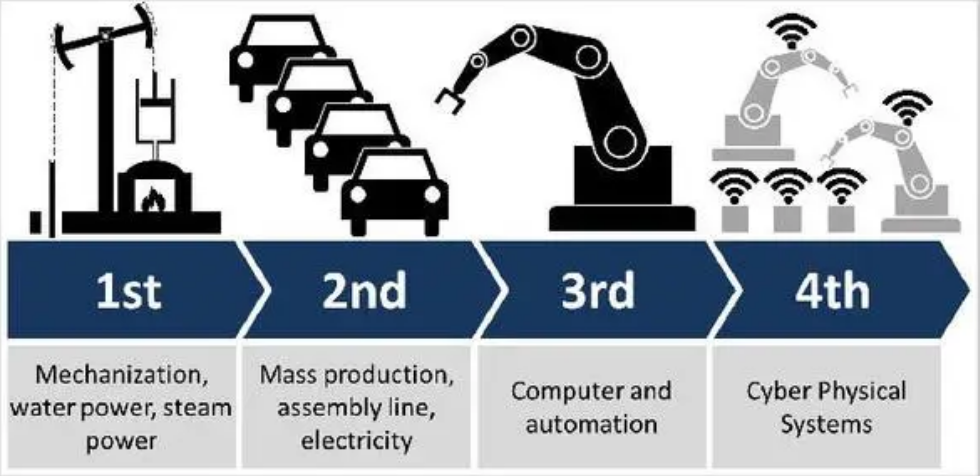

Carlota Perez expanded on Schumpeter’s notion of creative destruction and defined installation periods when new technology is still experimental and deployment periods when the technology diffuses widely across the economy after financial crises force complete business process adaptation. Perez identified three key dynamics that distinguish the installation and deployment periods – the extent of knowledge diffusion, shifts in labor income share, and the age profile of capital stock.

Analyzing data since 1925 reveals the variation in economic growth aligned with successive industrial revolutions. Investment spending surged between 1943 and 1974 as aged capital stock from the prior era was renewed on a massive scale, but then slowed as the new information and communication technologies of the current era began to emerge. Labor productivity peaked between 1947 and 1970 as the now mature technology of the prior era was fully deployed, but then slowed while awaiting full adaptation of business processes and practices to the capabilities of the new technology paradigm. Total factor productivity showed similar dynamics of an initial surge as old technologies were exploited followed by a slowdown as the capabilities of the new technologies were only partially absorbed.

The empirical record shows that industrial revolutions exhibit faster economic growth rates in deployment periods after major financial crises than in installation periods before crises. But the data also reveals growth has slowed across successive mature economy revolutions as opportunities for productivity-enhancing investment are increasingly fully exploited. In recent decades, emerging economies, especially China and India, drove global growth until the broad slowdown following the 2008 financial crisis.

The data on capital investment further shows that capital deepening, as measured by the growth in the ratio of capital to labor, accelerated as aged capital stock was renewed on a massive scale between 1943 and 1974, but then slowed in the current era as the new information and communication technologies began to emerge while much legacy capital remained in place. Labor productivity surged between 1947 and 1970 as the now mature technology of the prior mass production era was fully deployed across the economy, but then weakened as the economy awaited the redeployment and full absorption of the newer digital technologies. Total factor productivity followed similar dynamics with a surge as capabilities of old technologies were fully exploited after World War 2, followed by a slowdown as the capabilities of newer digital technologies were only partially absorbed.

The empirical investment data shows a massive surge between 1925 and 1974 as aged capital stock was renewed, but investment spending slowed in the current era even as new digital technologies emerged because so much legacy capital remained in place. The productivity data tells a similar story, with labor productivity peaking between 1947 and 1970 as the mass production technologies became fully deployed, but then weakening in subsequent periods as the economy awaited the fuller redeployment and absorption of the capabilities of the newer digital technologies of the current period. Total factor productivity followed comparable dynamics.

The long-lived nature of tangible and intangible capital, with the embedded nature of existing technologies, means that fundamental change in growth capabilities occurs only slowly over time. The data on capital age since 1925 confirms this dynamic. Structures exhibit the longest average lifespan, equipment the shortest. But even intangible intellectual capital on average lives longer than equipment. From 1925 to 1945, the average age of capital rose as investment slowed dramatically amid successive crises. Capital then renewed substantially between 1943 and 1974 as robust postwar growth took hold. However, the age of capital has increased again in recent decades as digital technologies have continued to rapidly advance while much legacy capital remains in place.

In summary, the empirical evidence points to recurrent periods of rapid growth driven by new surges in transformative technology followed by slower growth periods as the capabilities of new technologies are only partially absorbed while much legacy capital remains in place. Capital renews substantially after major financial crises destroy obsolete firms and force widespread business adaptation. Knowledge diffuses, the labor share of income rises, and productivity accelerates as new technologies are deployed across most industries. But predictable slowing follows as opportunities become more fully exploited and markets approach saturation. Understanding these empirical dynamics of industrial revolutions can provide guidance for business leaders and policymakers seeking to reaccelerate growth and productivity.